Remember that fixed costs are fixed over the relevant range, but variable costs change with the level of activity. If Bert wants to control his costs to make his bike business more profitable, he must be able to differentiate between the costs he can and cannot control. Distinguishing between fixed and variable costs is critical because the total cost is the sum of all fixed costs (the total fixed costs) and all variable costs (the total variable costs).

Accounting for Managers

For Carolina Yachts, their direct labor would include the wages paid to the carpenters, painters, electricians, and welders who build the boats. Like direct materials, direct labor is typically treated as a variable cost because it varies with the level of activity. However, there are some companies that pay a flat weekly or monthly salary for production workers, and for these employees, their compensation could be classified as a fixed cost.

Table of Contents

Using the same spreadsheet set up in step 2, select Data, Data Analysis, and Regression. A box appears that requires the input of several items needed to perform regression. Input Y Range requires that you highlight the y-axis data, including the heading (cells B1 through B13 in the example shown in step 2). Input X Range requires that you highlight the x-axis data, including the heading (cells C1 through C13 in the example shown in step 2). Check the Labels box; this indicates that the top of each column has a heading (B1 and C1).

- When labor costs are incurred but are not directly involved in the active conversion of materials into finished products, they are classified as indirect labor costs.

- These costs are often contractual or legally binding, making it challenging for businesses to reduce or eliminate them without incurring penalties or legal consequences.

- Period costs are simply all of the expenses that are not product costs, such as all selling and administrative expenses.

How much are you saving for retirement each month?

It is important to note that manufacturing overhead does not include any of the selling or administrative functions of a business. When labor costs are incurred but are not directly involved in the active conversion of materials into finished products, they are classified as indirect labor costs. Table 5.3 provides the total and per unit fixed costs at three different levels of production, and Figure 5.3 graphs the relation of total mixed costs (y-axis) to units produced (x-axis). Why is it so important for Bert to know which costs are product costs and which are period costs? Bert may have little control over his product costs, but he maintains a great deal of control over many of his period costs. For this reason, it is important that Bert be able to identify his period costs and then determine which of them are fixed and which are variable.

Which of these is most important for your financial advisor to have?

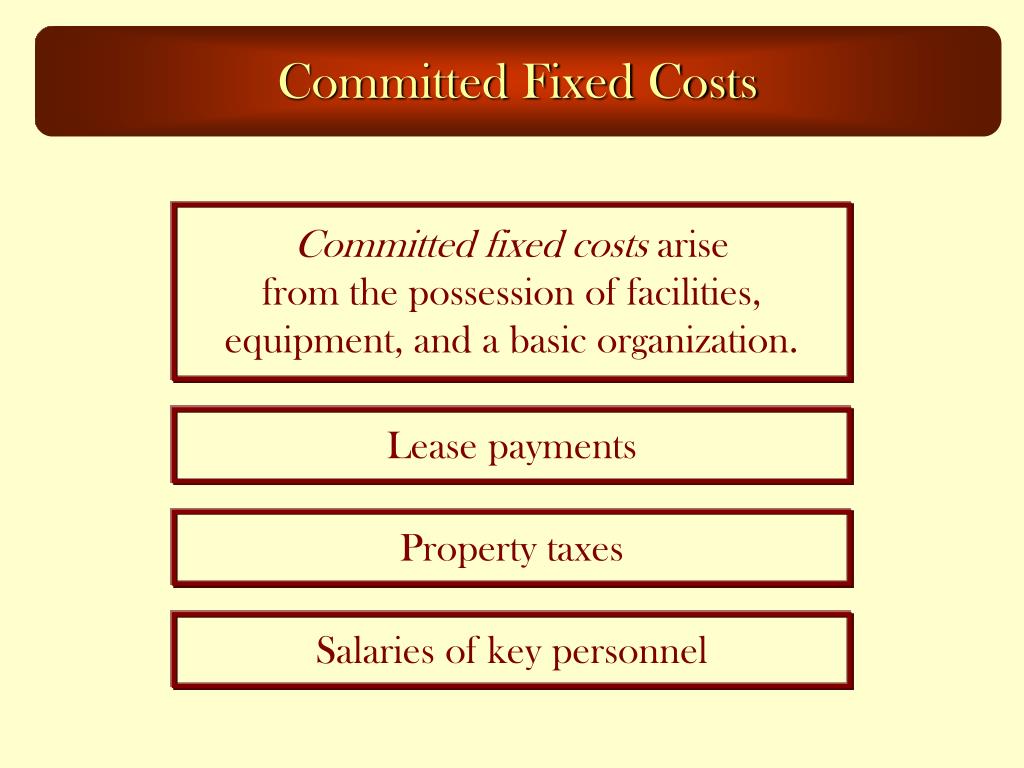

These costs arise from long-range decisions made by top managers about the size and nature of their organization. After further work with her staff, Susan was able to break down the selling and administrative costs into their variable and fixed components. (This process is the same as the one we discussed earlier for production costs.) Susan then established the cost equations shown in Table 2.5 “Cost Equations for Bikes Unlimited”.

Key Equation

A fixed cost2 describes a cost that is fixed (does not change) in total with changes in volume of activity. Assuming the activity is the number of bikes produced and sold, examples of fixed costs include salaried personnel, building rent, and insurance. Since discretionary fixed costs are defined as those that ebb and flow over long periods of time, they can vary widely based on the type of business you operate.

It is important, however, to be able to separate mixed costs into their fixed and variable components because, typically, in the short run, we can only change variable costs but not most fixed costs. To examine how these mixed costs actually work, consider the Ocean Breeze hotel. When creating a budget or business plan, it’s also important to consider fixed costs versus variable costs. Variable costs differ from discretionary and committed fixed costs in that they often change every month. For instance, if your company uses advertising on social media and pays per click, you may find that in some months you spend $100, while you are charged over $1,000 in others. This cost is wholly dependent on how effective the advertisement is and on how many people choose to click on it.

In managerial accounting, different companies use the term cost in different ways depending on how they will use the cost information. Different decisions require different costs classified tips for keeping your tax data secure in different ways. For instance, a manager may need cost information to plan for the coming year or to make decisions about expanding or discontinuing a product or service.